With the new year come old tax responsibilities. Graphic: @BrnoDaily

Usually, your employer does your tax return for you, or you can do it by yourself or with the help of a tax advisor. But what do you do if your home country wants to tax you as well?

To avoid double taxation you can apply for a tax domicile at your local tax office. This document proves that you are a tax resident in the Czech Republic and that the Czech Republic is where you should be paying your taxes.

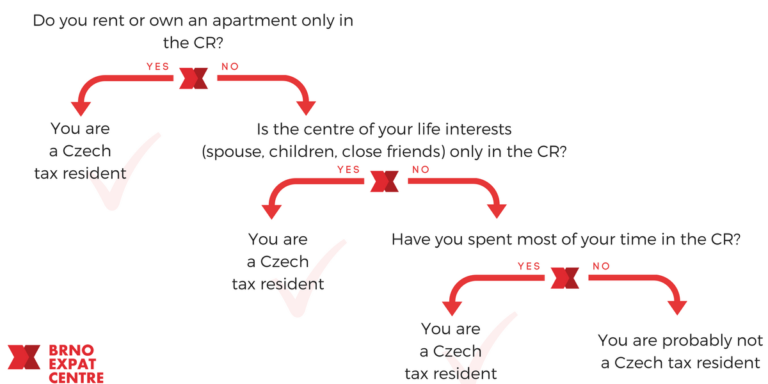

Brno Expat Centre (BEC) has published a new infosheet with a step-by-step guide to obtaining a tax domicile.

First, determine your tax residency by answering the sequence of questions presented in the infosheet. If you are indeed a Czech tax resident, you can then follow the process of applying for a tax domicile: learn where to go (there are several Financial Offices which serve different districts of Brno), which type of domicile you need, and what documents you are required to present.

Download the infosheet for free at: https://www.brnoexpatcentre.eu/download/tax-domicile/

If you are unsure about your tax obligations in general, or you need some other tax regulation or procedure explained or clarified, come to BEC’s event Meet the Expert: Taxes. (Be sure to make an appointment on the BEC website beforehand.) Meet an experienced professional ready to answer your questions during a free-of-charge consultation in our office, and learn how to survive the Czech tax season.